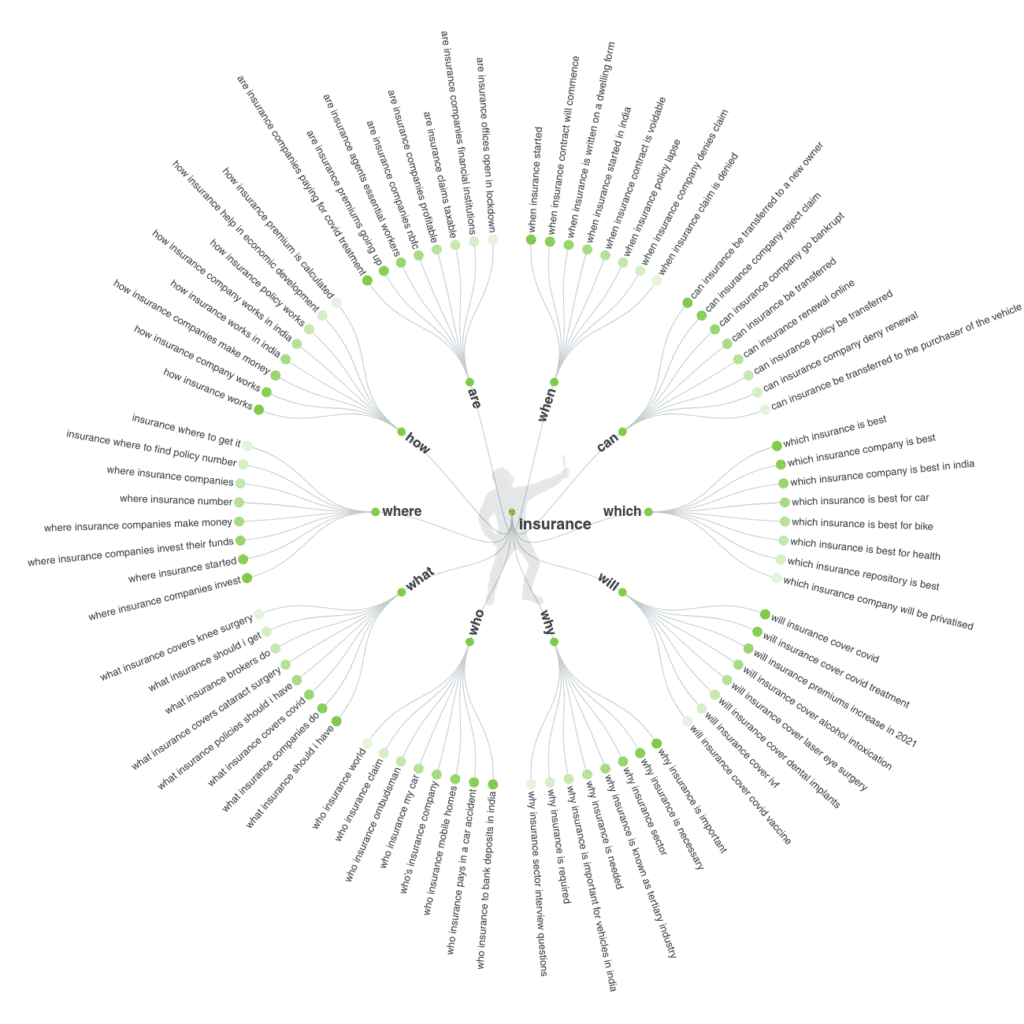

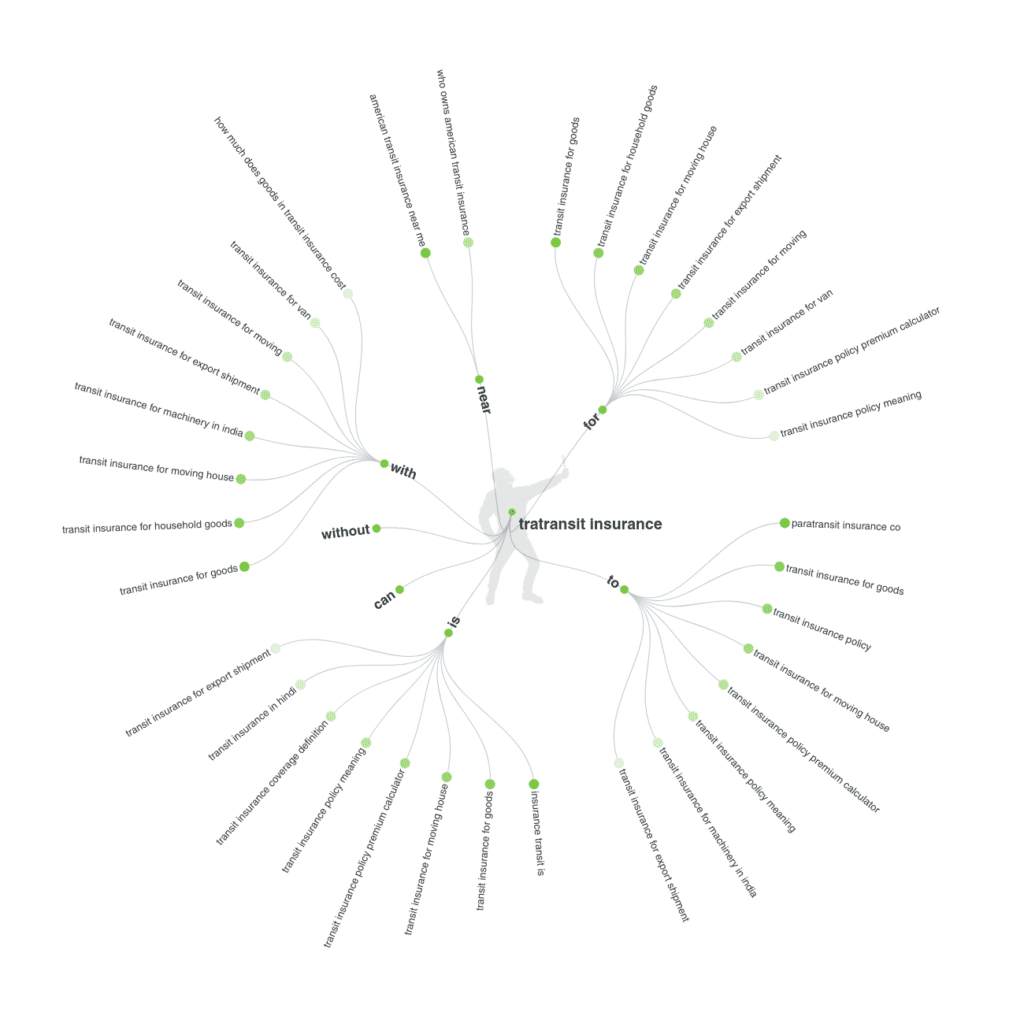

Transit Insurance ? The goods produced or marketed make up the wealth of a company and must be protected in the best possible way, especially during their transport. The transport of goods is an activity that is as important as it is risky. Verifying the insurance position of transport suppliers is a fundamental activity in the risk management procedures of every company. It must be carried out carefully and repeated every year even if the suppliers remain the same. To protect their products from damage during transport, companies can resort to targeted insurance solutions.

Forms of policies on the transport of goods date back to 1300, at the height of a merchant activity in which the success of an expedition could determine the fortune or failure of the entrepreneurs of the time. It is, in fact, the first form of insurance that historians have news of. Transport is undoubtedly less at risk than it was then, but transport risk insurance has remained essential to any merchandise trading.

Related :-

Warehouse and Small Temporary Storage Rental Services

Truck Rental Services

Crane Rental Services

If the cargo is in transit, there is a risk of damage or loss of the load. Suppose the shipment is lost at sea due to the sinking of the container ship. The carrier’s liability is usually not sufficient to cover the value of the cargo. If your truck gets involved in an accident, you just lost two assets, your truck and your property.

Therefore, it is essential to consider freight insurance for your cargo. Transit insurance protects you from financial loss due to damage or loss of your logistics. You will pay the amount that will be insured if the event in question occurs on the cargo. And these targeted events are usually natural disasters, car accidents, cargo abandonment, customs denials, war acts, and piracy. It also differs from carrier liability and insurance policies commonly available from dedicated freight and freight insurance companies, freight carriers, agencies, and large brokers.

Why an insurance policy?

The world of transport is complex and regulated by uniform regulations governing cases of carrier liability.

If the goods are lost or damaged during the journey, the carrier should by law respond by compensating for the damage suffered by the company. However, only in some cases is it possible to identify the carrier’s liability for compensation and, even if it is ascertained, the compensation is not insured.

Many events to the detriment of companies also occur due to force majeure, so the damage is inevitable, as in atmospheric events, robberies, or other unforeseen events.

We were taking out insurance specifically designed to protect the business from damage to the goods during their transport guarantees the right to complain directly. It obtaining compensation for the damage and eliminating the dispute, even if the carrier has no responsibility, is insolvent or the limit to the compensation that the carrier is required to pay for total or partial loss of the goods is lower than the value of the goods. The national road transport is characterized by a negligible limit and misaligned with what is instead applied internationally. Often the debt limit is insufficient to guarantee compensation for the damage suffered in full.

Transport frequently involves a plurality of subjects (logistics companies, transit companies, intermediate carriers, terminals), each of which has a responsibility that begins when the goods are taken over and ends with the delivery to the next subject. It is not always easy to identify the exact point where the damage occurred and consequently the person responsible, with the apparent risk of being rejected. Moreover, in single-vehicle or small-sized companies, carriers are often not adequately insured or even not fully insured.

If the policies exist, they may be incomplete, with excluded guarantees and with unsuitable ceilings to guarantee cases of willful misconduct or gross negligence. The carrier is liable for the total amount of damage it has caused.

The Goods carrier ‘s liability also can not be translated into an immediate right to the payment of damages. It is often necessary to discuss and start very long litigation in which it may be required to be assisted by a lawyer and bear the costs. The compensation you get from your insurer is direct and allows you to avoid disputes with the transporters. Any recourse actions will be carried out directly by the insurer only after it has compensated the damage.

The truckers must reimburse the costs that its contractor incurs for the appraisals and the assessment of damage, but these costs are often the subject of discussion. The carrier usually struggles to recognize the fees for the destruction and disposal of the residues of the accident and the cost of clearing the roadway following a cargo spill.

The policy guarantee adequate compensation in all these cases. Even if the responsibility for the damage to the goods was the sender or the recipient.

For example, in the case of insufficient packaging or deterioration due to physical characteristics of the goods, such as fresh food transported without the use of a vehicle.

Related :-

Advantages of road transport :- Please Click

Disadvantages of road transport :- Please Click

Oversized Load Transportation Problems :- Please Click

The policy on the transport of goods

Although it is possible to ensure a single transport with a policy dedicated to it ( travel insurance certificate ), the most common insurance formulas are timely, i.e., they allow to guarantee the expected company movements over a period that is usually equal to one year.

They can be completely automatic. They do not require any intervention, or they can be declared in advance or postponed for individual shipments.

In the event of total damage on a full load, a compensation can be reached. For partial damage, it is necessary to calculate the weight (gross of packaging) of the goods involved.

There are prevalent and widespread forms of temporary contracts:

Pay-as-you-go subscription policy:

used to cover a supply contract that requires a plurality of subsequent shipments. Its purpose is therefore exhausted upon completion of the supply. It can agree on the total cost with the insurer and provide automation for individual loads.

Subscription policy (open policy):

It is mainly used for maritime transport and has the advantage of providing automatic coverage of all shipments, providing for their summary reporting within the set deadlines.

Revenue Policy:

Provides automatic coverage for all shipments that fall within the company’s sales revenue. It is the most used form because it simplifies operations without requiring any intervention during the year. It is convenient and advantageous but requires careful and scrupulous construction to guarantee full coverage of business needs.

Transport policy on behalf (stipulated by the shipper or carrier):

transport service providers can also offer insurance to their customers through a policy taken out on behalf of whoever is entitled. The operation is based on a specific order to insure given by the company to the shipper or carrier.

The insurance market offers primarily modular policies, made up of different sections (clauses) that complete the policy to adapt it to the company’s needs. E ‘ beneficial for each type of transport maritime, aerial, terrestrial, and rail and can, of course, be limited only to the shapes used.

Several decades of management and interpretation of transport situations and above all of the accidents have allowed specialized technicians to significantly improve even the same all risks policies by elaborating very sophisticated contracts, able to incorporate the increasingly complex commercial or modern transport execution practices.

Insurance is a contract that is entered into between a person or company and an insurance company. It is about the contracting party paying a premium for the insurance company to compensate him in cases in which a claim occurs.

Insurance companies have specific products for each type of claim, such as vehicle insurance covering all the risks associated with owning and using a vehicle.

Loss events occur daily in the process of Freight transportation. This affects not only specific products

Not only did you transport yourself, but also loading and unloading-

Either in the method of required intermediate storage or transfer between modes of transport. Based on many years of Extreme, in addition to experience from claims experts Meteorological phenomenon, transportation damage is mainly caused by

Less than:

- • Insufficient packaging

- • Inappropriate means of transportation

- • Under-trained staff

- • Lack of knowledge about a particular quality Goods

- • Inaccurate assessment when loading and fixing Goods

Also, organized crime and climate change, And the social conditions of many destination countries are increasing Danger. As a result, annual losses amount to billions. It adversely affects the commercial success of the company.

Recommended :-

Transport Department :- Please Click

History of Transportation :- Please Click

Importance of transport system :- Please Click

What does insurance for goods in transit cover?

The truckers products for transportation insurance with producers

Merchants have comprehensive protection against

- Loss due to damage in transit. This form of insurance is customizable and is not responsible

- From service providers such as freight carriers and carriers

- Warehouse managers are not subject to restrictions regarding

- Cause or quantity. In addition, damages and costs.

The above service providers are not responsible for Safe as agreed.

Advantages of transit insurance

- By buying the transit insurance, you are compensated if theft occurs of the goods or parts. This coverage is very advantageous because the insurance company replaces the vehicle’s value so that the beneficiary can buy another, so it does not affect the equity.

- In an accident on the road, the beneficiary receives immediate assistance, including towing service or road assistance. This is very important to preserve the safety of the occupants.

- In collision with another vehicle, the client receives compensation for the damage or of the goods. Where applicable, it will also compensate the owner and occupants of the other car.

- Goods are also protected against natural disasters such as earthquakes, floods, etc.

- In cases of vandalism, the insurance company pays the repair costs or, if it is a total loss, the declared value of the vehicle.

- Personal accident coverage covers the medical expenses of people who are injured due to car accidents, both for the occupants of the insured vehicle and for the other cars involved in the accident.

- Insurance companies make an advisor available to their clients to guide them in the corresponding processes, both in legal procedures and in those that have to do with the validation of damages.

- Insurance companies reward good drivers on their policy premiums. In this way, people who are respectful of traffic laws and are prudent when driving has additional advantages when contracting their vehicle insurance.

Disadvantages of the transit insurance

- Having to pay a premium, even if the insurance has not been used. Although this may seem like a no-profit expense, it isn’t, as it was protected for an entire year.

- When collecting compensation, the insurance company charges a premium; the premium is an amount of the claim that the company does not cover. This premium is higher as the policy has a lower cost. For this reason, it is not good to take out policies with very low amounts since the disadvantages are seen when collecting compensation.

- Depending on the type of claim, the insurance company investigates to verify the conditions of the accident. This can be annoying and delay the collection of compensation.

Damage due to improper packaging. If the damage to the product is due to improper packaging of the cargo, the policy does not cover it.

Damage caused by defective products. If the carrier can indicate that the damage is due to a defective shipment, the policy will not refund.

Certain types of cargo. Some insurance companies do not insure dangerous goods, certain electronics, and other high-value or fragile products.

Some modes of transportation. Some policies may only cover cargo if you are on a ship, plane, or Commercial vehicle.

Related :-

Trucks Truckers and Trucking

Goods Transportation Problems

Logistics Overview

Logistics Park

Conclusion

The transit insurance policy is beneficial for the transport owner to overcome accidental damages or any loss of goods during the transportation. It covers all the costs of the goods. It is very affordable and beneficial for the transport agencies to easy and secure transportation of the goods.

The main advantage of freight insurance is that it minimizes financial loss if the freight is damaged or lost. The small investment you pay (also known as a premium) gives you peace of mind while your goods leave your warehouse.

Click and follow for regular dangerous road accident news report for TRANSIT MARINE INSURANCE POLICY :- Please Click

Frequently Asked Questions FAQ :-