GST Impact ? Transportation is associated with shifting of goods, passengers, etc from one place to another using different modes like roadways, railways, airways or through water. Transportation is an activity which connects different business with suppliers and customers. Transportation has an major impact on Indian economy.

After GST was introduced it had an positive impact in the transport sector. It has helped to ease the movement of consignment, goods via roads, rails, air and sea. 20% increase in transport efficiency was noted due to the dismantling of various checkpoints. The e-way bill has also helped drivers as it reduced the burden of enduring the procedures at various checkpoints.

The Planned GST system has replaced several state and federal tariffs for a single tax. Previous complicated tax structure in India referred that logistics decision, choice of setting up warehouses and distribution center , were taken on the basis of tax regime which included central sales tax and state value added tax rates.

GST unleashed an new era of developing logistics infrastructure, taking investments to new level and transportation. Transport vehicles used to waste about five to seven hours daily at interstate checkpoints. As per the estimation by World Bank, simply having delays due to roadblocks, tolls and other stoppages could cut freight times by 20% – 30% and cost logistics by 30% – 40%.

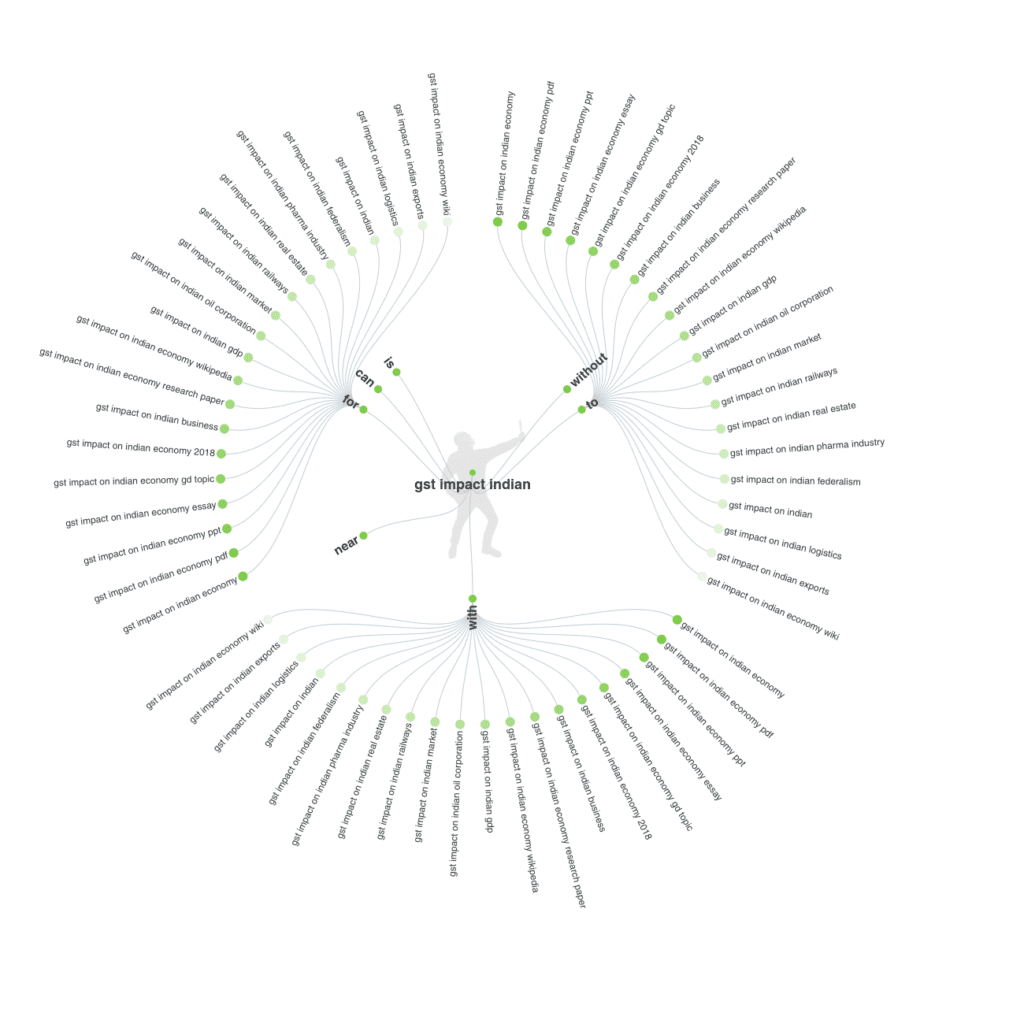

Impact of gst on Indian economy :–

As per the GST Law 2017, services by way of transportation of goods by road is not kept under GST so no GST tax is payable on it. GST will only payable on services of Goods Transportation Agency ( GTA ).

Goods Transportation Companies :-

GTA is any person of firm who is providing service in relation to transport of goods by road and issues ‘Consignment Notes’. If the service provider does not provide consignment note the transport of goods by road won’t be taxable. Services of GTA in transporting goods will account for GST at 5% or 12%. In 5% GST you cannot take the credit of input tax charged on goods or services. Any service provided by GTA to an unregistered person including an ‘unregistered casual taxable person’ will be considered Nil except following recipients :

The following are considered to be service recipients :-

- Factories registered under Factories Act, 1948

- Society Registered under Society Registration Act, 1860

- Person registered under CGST Act, SGST Act, IGST Act, or UTGST Act

- Established Corporate Body

- Any registered or unregistered partnership firm

Government has also kept some GTA Services out of the GST Act. Below is the list of some such services : –

- Agricultural Produce

- Flour, pulses, rice ,milk, salt and other food grains

- Organic Manure

- Registered Newspapers or Magazines

- Relief materials going for victims of natural or man-made disasters

- Defence Equipment’s

Rates of GST on Different Modes of Transportation India :–

Roadways GST Rate :- (surface road transportation service)

Road transportation goods are subjected to 5% or 12% GST tax with credit availability to input tax.

Airways GST Rate :- (Aviation Industry GST)

Good transport is taxed at 18% for within India and out of India with credit availability to input tax.

Railways GST Rate :- (Rail Train Transportation Industry)

Goods transportation through Indian Railways are subjected to 5% tax with credit availability and this makes a strong competition between road and rail transport. For transportation of goods other than Indian Railways tax is charged at 12% with credit availability.

Waterways GST Rate :- (Water Transportation Industry)

Waterways transportation is charged at 5% with credit availability.

Benefits of GST on Indian Goods Transport Services :–

Simplified Tax :-

The implementation of GST removed various taxes and tariffs of each state. This reduced the complexity which was faced in transportation of goods before GST. Before transporters had to pay different tax in every state. All these tax rates were different. GST brought out “ONE TAX ONE SOLUTION” system.

Reduction Warehouse cost :-

The previous tax system used to collect higher logistics cost. It was reduced to about 20% after the implementation of GST. As each state used to have different tax rates, companies used to own warehouses in each state instead of at one place which also increased warehouses costs. After implementation of GST companies don’t need to get warehouses in different state and this improved logistics.

Increase Efficiency :-

One tax one solution has made transportation seamless throughout the country with the removal of multiple checkpoints, entry permits, extra paper works, etc. After GST all the complexities in transport sector in various states are removed. These saves transportation time, operating costs and efficient logistics.

Driven By Technology :-

GST has entail a new set of compliance requirements and to fulfil this companies will require to adopt new ERP accounting systems and stock management systems. The industry is now able to avail tax credits for all its good, goods vehicles, delivery vans or packing machinery. The introduction of e-way bill has helped the firms in the industry to sort out the confusion by maintaining uniformity in the industry.

Reduced Paperwork and Consolidation :-

Under GST lot of taxes like entry tax, OCTROI has been removed. Removal of this kind of taxes had ease the paperwork procedure for the logistics service providers.

Disadvantages of GST :-

- Some experts says that GST is nothing new but it is just a new name given to the previous tax system.

- The service tax was 15% previously but now it has become 18%. Due to this many services have become costlier with telecom, airline, and banking affected mainly.

- This new GST Act has given the control of business to state and central governments. The business owners are now more confused about the system as they are facing issues to understand the rules identified.

- After implementing GST government collected a large amount of money through taxes in its first few instances. Businesses had to let go large amount of tax . Several businessmen complained about not getting the credit of input tax. Officials found some mismatch of data and they denied the credit of input tax to many. As a result many had chaos with the officials and are not happy with the GST.

- This GST Act had not been so fair with the disabled people. Many things that were tax free earlier for disabled people had now been included under GST tax. Before implementation of GST brail paper, hearing aid and motorized wheelchair were tax free but now this things are also being taxed.

- Government has not spared banking systems also. At one side they are trying to give push to banking services and insurance in India and on other side government taxed banking and insurance services at higher rates when compared to previous rates.

- Implementation of GST also had an negative impact on discount and rewards program. Before GST product was taxed on post-discount rates but now the products are taxed on pre-discount rates. Many companies have suspended their rewards program.

- As the government chose the mid year for launch of GST this lead to problems in taxation and reporting during the end of the financial year. For good reason government should have launched GST at the end of the financial year it would have avoided the confusion during taxation and reporting.

- As per the GST rules sellers need to get registered in every state he is doing business and this has increased more burden and complexity for seller. The government should have thought of a centralised registration procedure to ease the work sellers during the rollout.

- GST offered return tax benefits to other business but only transport sector has been kept deprived of it. Though transport sector plays an important role in the economy of country it has been kept away from return tax benefit.

- Most of the check posts were deactivated after the implementation of GST. Before GST transport vehicles were checked at every check posts. This was time consuming and also the officials at check posts used to harass drivers and fine money for no valid reason. After deactivating check posts there was decrease in corruption, transportation cost and time. But now this check posts have started again and the situation have become as it was before.

- Complexities in the structure and implementation GST is preventing local firms from investing in the market. Also government gives more free environment to the foreign investors in tax and rules. These partiality with our own business sectors is not at all valid.

Conclusion :-

Government is keeping more trust on the foreign investors while ignoring small and local investors. If government shows a firm belief in local investors India could achieved heights. That’s the difference between India and China. China firmly linked its business sector with country and now we can see its result. China is among the fastest growing economy and they are doing well with their own made products in the entire world. In India every state, every region, every politicians keeps their own profit ahead and works according to that. If this continues in India, India will soon see its worst phase.

No doubt many sectors have been doing good after implementation of GST but still there needs some improvement in implementing GST. Partiality between local and foreign investors should be vanished. Rules should be same for every businessmen and then only we can see a fair competition.

Click and follow for regular warehousing Upgraded Updated news report :- Please Click

Recommended :-

- Please click and See Our Endless Journey – Please Click

- Manufacturer association in India – AIAI India ( www.aiaiindia.com )

- Merchants manufacturer industries manufacturing companies

- Difference between sales and marketing

- Fraud Cases and Examples in Business

- Business Problems and Solutions

Public frequently asked questions (FAQs) :-